COVER STORY

Continued growth and a new set of challenges for the post-pandemic cold chain in 2021.

2021 State of the Industry: Plant Proteins

Research by ADM shows consumers are demanding more variety, improved taste, and realistic texture in replicating meat for plant-based products.

2021 State of the Industry: Frozen Foods

The American Frozen Food Institute (AFFI) explains why frozen food sales continue to exceed post-pandemic forecasts.

At this time last year, those working along the cold chain were collectively trying to figure out how to navigate daily—sometimes hourly—changes and disruptions to business in the middle of a pandemic. Today, as the pandemic wanes in the U.S., a new set of challenges exist, but the industry is better prepared and positioned to overcome many of those obstacles, having rapidly evolved their operational strategies in the coronavirus crucible last year. Overall, as you’ll see below, the cold chain looks robust at the mid-point of 2021.

Also, for a deeper dive into the forecast for frozen foods by AFFI, and for comprehensive research on plant-based proteins courtesy of ADM, be sure to read our State of the Industry subsections by clicking the photos above.

Strong Sales for Cold Foods

“Our retail sales grew 150% during the pandemic, and while this year may not be 150% year-over-year again, it’s still growing between 40% and 50%. Also, foodservice is a large part of our operation, and that’s coming back this year,” says president & CEO of Devanco Foods, Peter Bartzis.

Devanco’s outlook could be a microcosm of what to expect for cold foods companies the rest of 2021 and into 2022. As expected, with pandemic restrictions fading and the general population increasing their mobility for work and leisure, sales of refrigerated and frozen foods are normalizing from the record-setting heights of 2020, but much of that momentum has carried through to 2021, as a combination of new customers, new buying habits, and e-commerce/direct-to-consumer options are fueling demand for cold foods.

According to statistics from the National Frozen & Refrigerated Foods Association (NFRA) and Nielsen, by the start of May 2021, retail refrigerated food sales were up +7.3% compared to May 2020, after finishing last year at +13.3%. Frozen foods sales were at +12.1% this May, after finishing 2020 at +20.4%.

Translated to dollars, frozen foods are holding steady year-over-year at approximately $67 billion with 17 billion units sold, while refrigerated foods are around $82 billion and 28 billion units sold. Unit sales for cold foods overall in 2021 are down slightly compared to the end of 2020—about -191 million for refrigerated, and -171 million for frozen—so the comparable dollars in sales can likely be attributed to inflation and a rise in food prices, which may continue through the end of 2021.

Market research firm IRI summed up the outlook for cold foods in a recent report: “At-home consumption remains elevated due to lingering stay-at-home behaviors, and as mobility improves, this elevation may erode but will remain higher compared to pre-COVID-19 levels.”

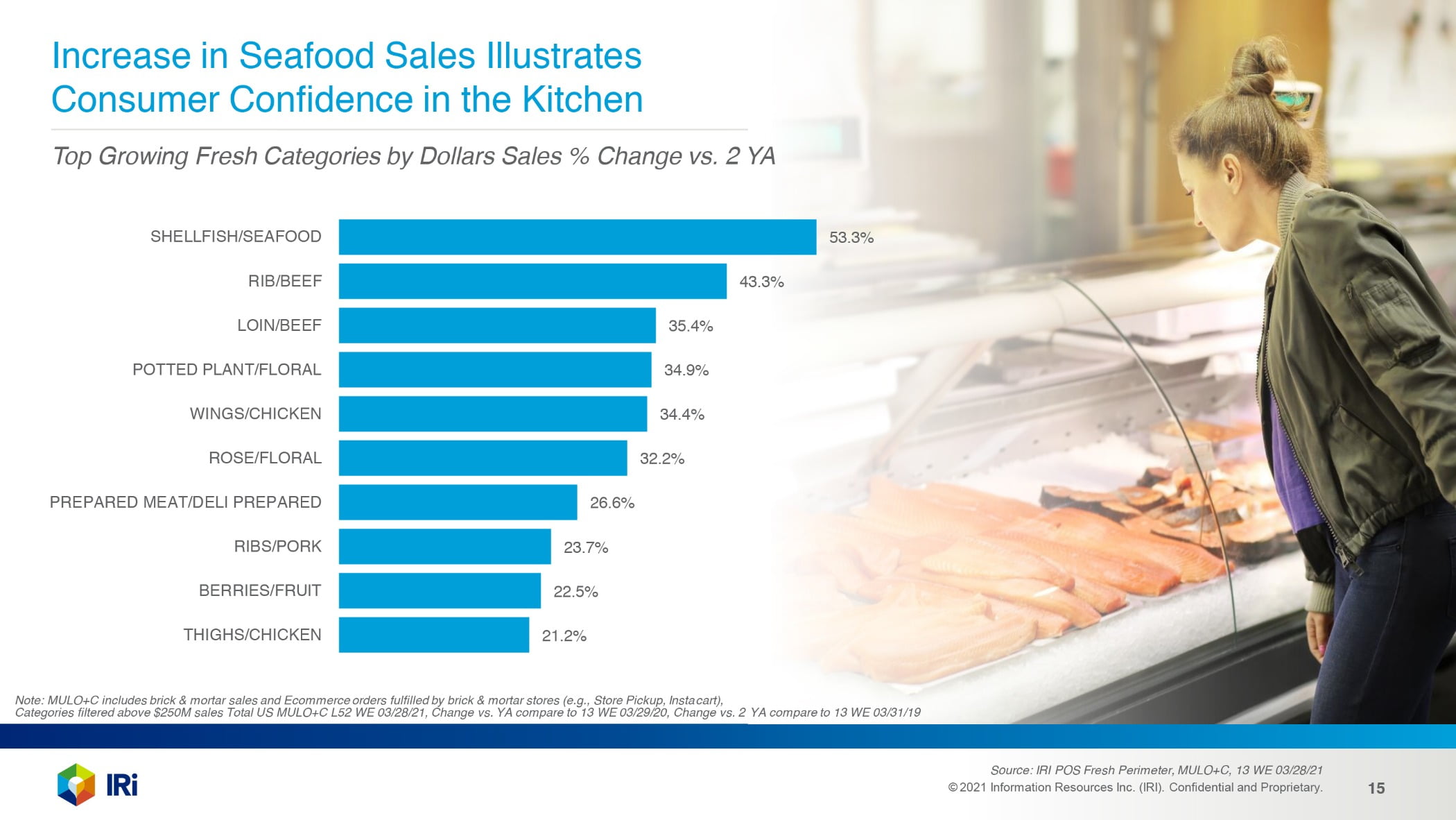

Seafood--both refrigerated and frozen--saw giant leaps in demand and sales last year that continue into 2021. Chart courtesy of IRI Q1 2021 Emerging Growth Pockets.

Supply Chain Struggles

A shortage of ingredients to make cold foods is just one aspect of a supply chain currently in flux—and contributing to the inflation mentioned earlier—with stops and starts of product flow amplified by events like the blockage of the Suez Canal earlier this year, plus an ongoing backup of cargo ships at U.S. ports along with a shipping container shortage. Other factors include a perpetual labor crisis in the industry, particularly with truck drivers and logistics personnel to move products from point to point.

“It’s still increasingly difficult to buy and source ingredients as costs are going up. Our lead times have doubled or tripled in some cases, making it difficult to schedule production, so all of this is a perfect storm for increasing costs that, unfortunately, will eventually be passed on to consumers,” says Lauren Edmonds, president of the Refrigerated Foods Association (RFA) and VP of R&D and marketing at St. Clair Foods, on a recent Cold Corner podcast.

“For instance,” Edmonds continues, “corn starch has been difficult to get, and the market has been unstable for oils, which we use for our mayonnaise products, so the costs are skyrocketing. Either it’s an ingredient we’re purchasing that’s been difficult to get, or our suppliers are having difficulty sourcing what they need. It’s a snowball effect that’s affecting the entire industry.”

Evolving e-Commerce

The pandemic has been called the great accelerator for its effect on speeding the evolution of the cold chain by years within a matter of weeks in 2020, and what was already growing from an e-commerce standpoint prior to COVID-19 has emerged as a dominant force for delivering cold foods today. Numerous startup food companies are debuting their products as direct-to-consumer delivery before securing retail partnerships (or bypassing retail entirely) and consumer-buying habits developed during the pandemic have made it commonplace to order perishable foods delivered to a doorstep.

According to research by real estate firm Coldwell Banker Richard Ellis (CBRE) and Forrester, e-commerce demand for cold foods currently outpaces nearly every other product for home delivery in terms of growth. Refrigerated food sales via e-commerce were at +84% last fall, compared to +54% pre-pandemic, while frozen foods were at +74% vs. +63%, respectively.

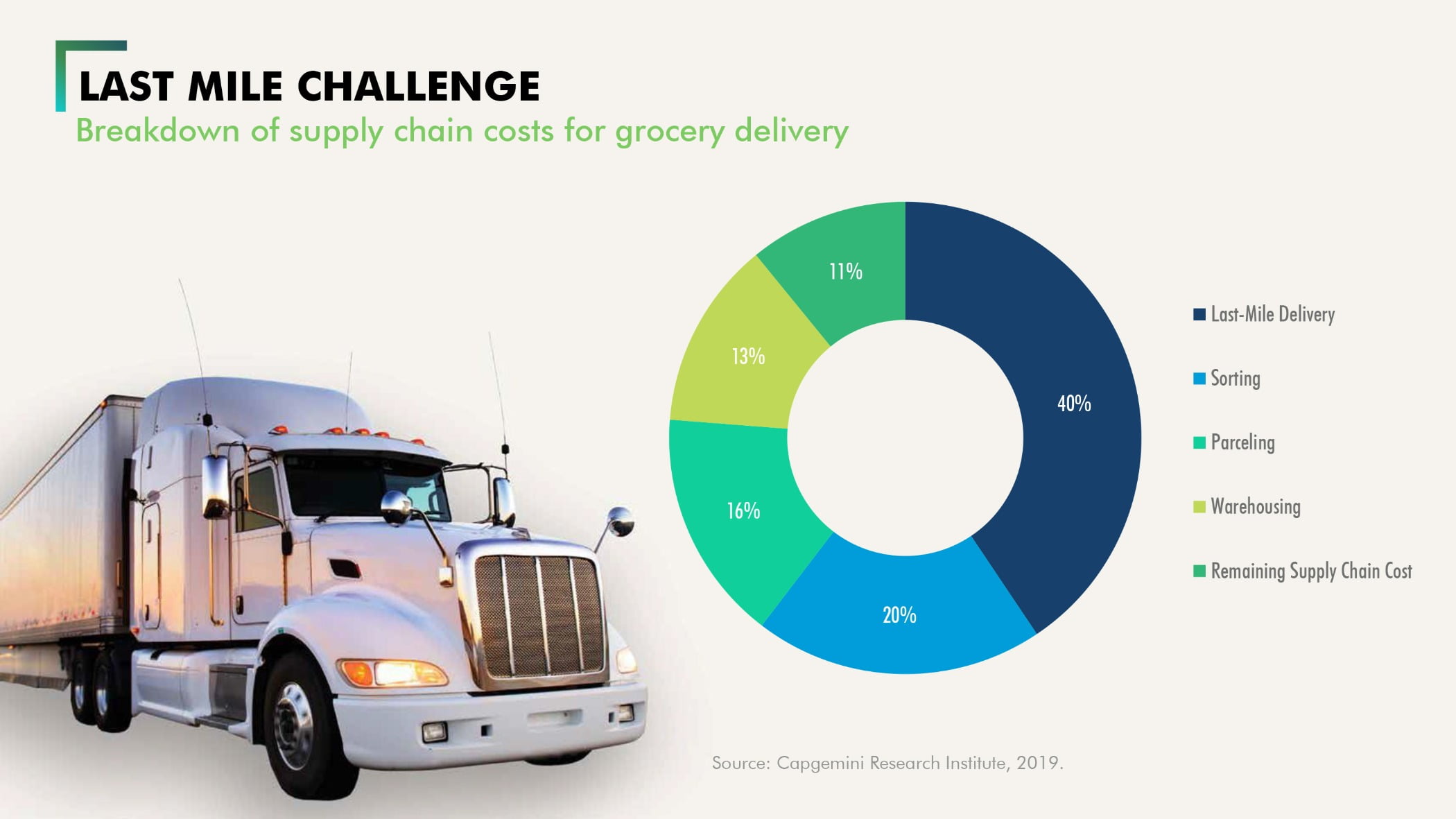

These continued gains, of course, leads to an increased reliance on last-mile delivery, impacted by the current shortage of truck drivers and personnel to fulfill those orders. Some companies are experimenting with autonomous vehicle delivery to execute those last-mile obligations, but we’re still a long way from self-driving drop-offs easing the labor crunch.

Another evolving area related to e-commerce is sustainable packaging for cold foods. Processors—particularly new brands—are trying to balance environmental responsibility with their own bottom lines, since sustainable packaging can sometimes be more expensive than traditional cold foods carriers like Styrofoam and frozen gel packs. With shipping costs increasing and some delivery delays inevitable, sustainable packaging needs to hold the cold, so to speak, beyond a single day, since thawed product can be disastrous to a budding brand’s reputation and their direct-to-consumer ambitions.

According to research by CBRE and Forrester, e-commerce demand for cold foods outpaces nearly every other product for home delivery in terms of growth, increasing the need for last-mile deliveries. Chart courtesy of CBRE Food on Demand June 2021.

Cold Storage Demand

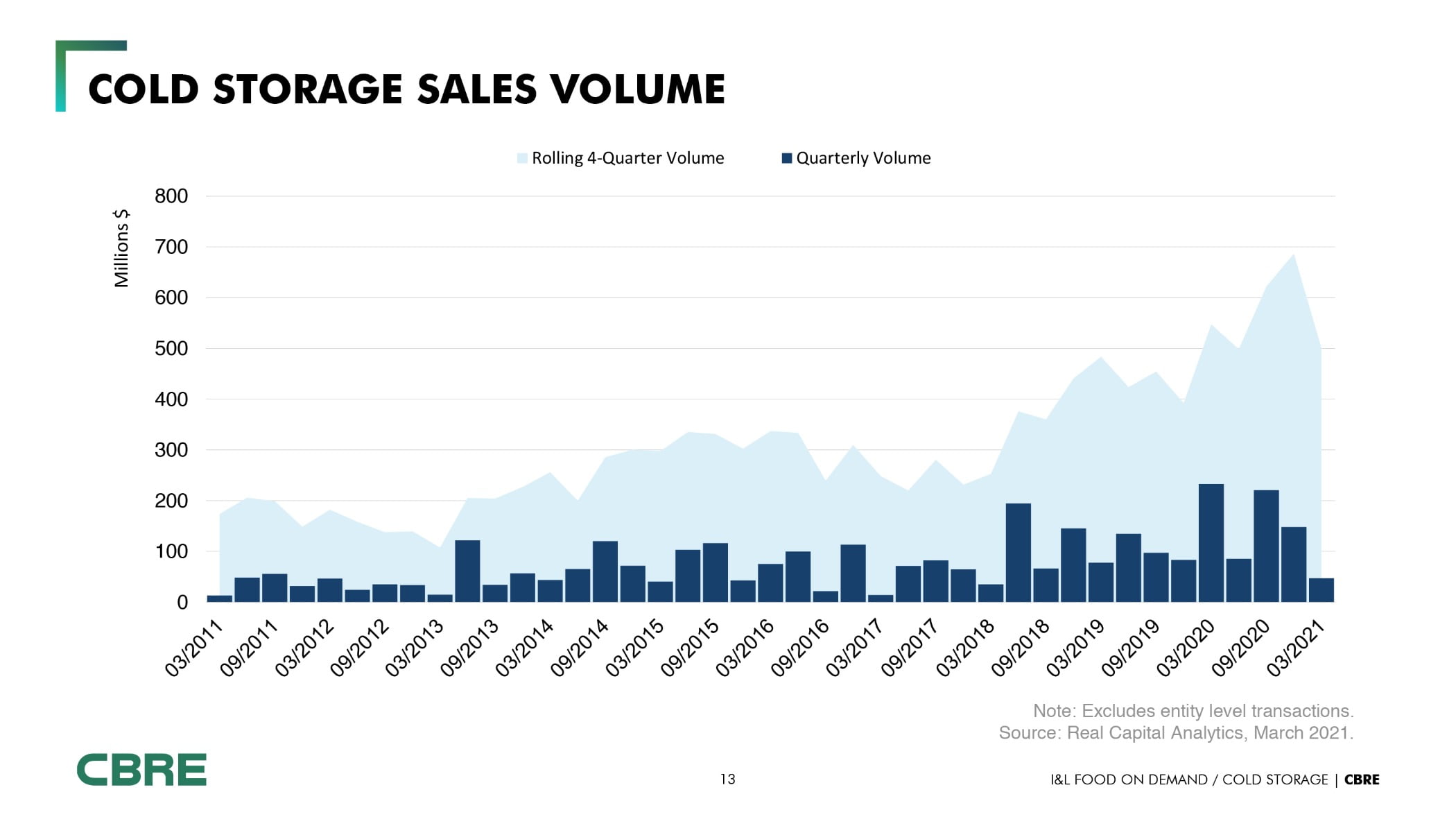

According to CBRE, the current inventory for retail cold storage is approximately 300 million square feet (MSF), while industrial cold storage is around 215 MSF. Higher consumer demand for cold foods, combined with growing e-commerce options, and the need for additional warehouses to fulfill last-mile deliveries, continue cold storage’s hot streak started last year.

“The current outlook for cold storage is strong based on limited vacancy and increased demand for frozen and refrigerated products in nearly all core, secondary and tertiary markets. Demand drivers for storage stem from lack of new-build projects, an increasing U.S. population, the trend toward home delivery, and the need for additional inventory to protect against supply chain disruptions,” explains Brian Niven, managing director at Karis Cold. “Several factors have led to where we are today. One significant challenge is the existing inventory of U.S. cold storage facilities has an average age of 40 years or more. These aging facilities lack the efficiencies of modern construction and operations. The complexity and diversity of these facilities, along with the capital expense required to build, has led to demand outpacing supply across U.S. markets.”

Owners of new-build and existing cold storage facilities are increasing their investment in automation as an option to help alleviate the labor crisis, increase efficiencies, and put existing employees into less physically demanding positions where their operational expertise and strategic decision-making become broader assets to a company.

CBRE estimates the current inventory for retail cold storage is approximately 300 million square feet (MSF), while industrial cold storage is around 215 MSF. Photo courtesy of Tippmann Group.

“The current outlook for cold storage is strong based on limited vacancy and increased demand for frozen and refrigerated products in nearly all core, secondary and tertiary markets," says Brian Niven, managing director at Karis Cold. Chart courtesy of CBRE Food on Demand June 2021.

Foodservice Returns

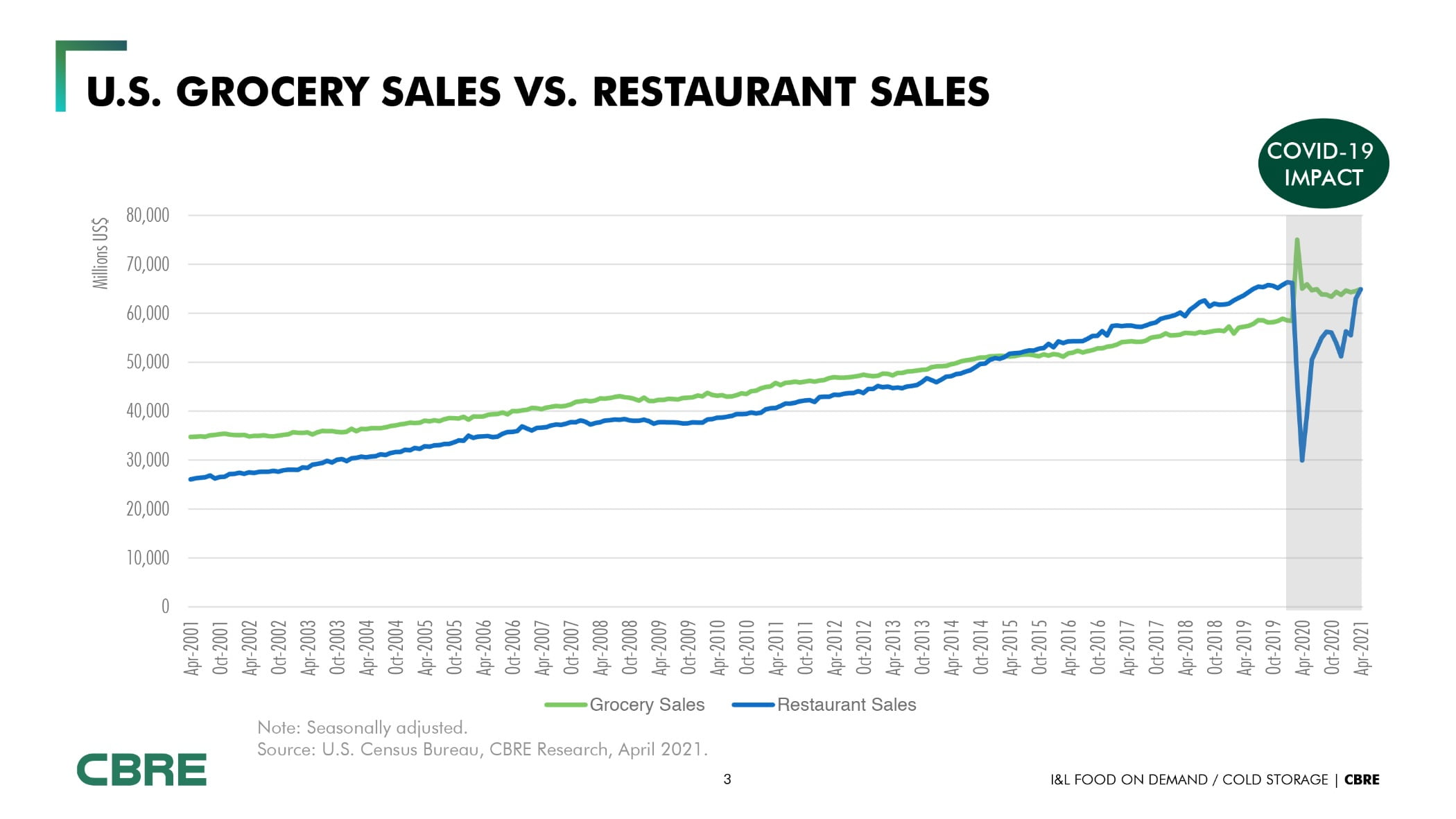

As Bartzis mentioned at the beginning of this story, foodservice is finally back, as most pandemic restrictions for on-premise dining in restaurants, hotels, catering halls, sports stadiums, and other volume venues have been lifted at the mid-point of 2021.

One of the industry lamentations of 2020 was that approximately 30% of total food sales were wiped out when COVID-19 led to a foodservice shutdown. Today, that lamentation has turned into exaltation, as the industry will likely see a 30% increase or more in food sales year-over-year by adding foodservice back to the mix. Combined with continued momentum for retail refrigerated and frozen foods, plus the ongoing rise of e-commerce/direct-to-consumer sales, the cold chain is set up for success as we enter the second half of 2021.

[Wachiwit]/[iStock / Getty Images Plus] via Getty Images

Foodservice sales actually outpaced grocery sales every year since 2016 until the pandemic in 2020. Foodservice is poised for a comeback this year due to pandemic restrictions being lifted for on-premise dining in restaurants, sports stadiums, event spaces, and other high-volume venues. Chart courtesy of CBRE Food on Demand June 2021.