AFFI

The frozen food aisle has been a growth driver for retailers since 2016 with acceleration ahead of most other departments. In 2020, frozen foods proved to be a pandemic powerhouse ringing in $65.1 billion in retail sales. One of the biggest questions coming out of 2020 was whether frozen foods could sustain those gains and maintain momentum. The answer at the mid-point of 2021 is YES!

Consumers Invested

The 2021 Power of Frozen, commissioned by the American Frozen Food Institute (AFFI) and conducted by 210 Analytics, found that 30% of Americans expanded their freezer capacity by adding a second fridge/freezer combination or a stand-alone freezer since the onset of the pandemic. This was a result of one of the most consistent and persistent pandemic grocery shopping trends of fewer, but bigger trips. Preparing many more meals at home highly favored frozen food and its longer shelf life — prompting consumers to invest in additional freezer space.

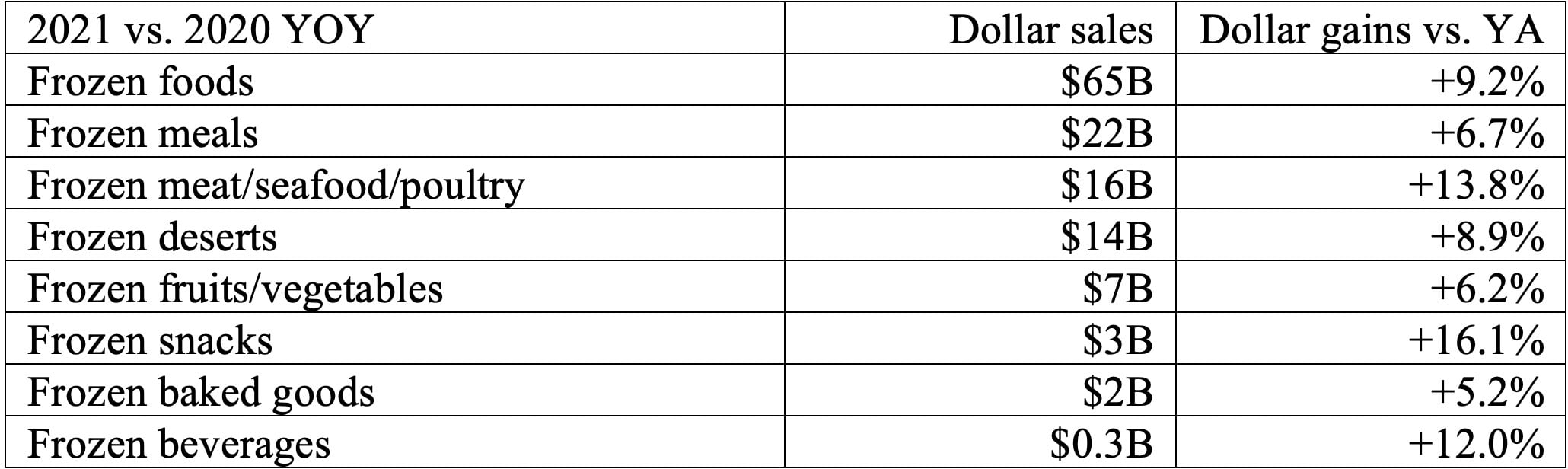

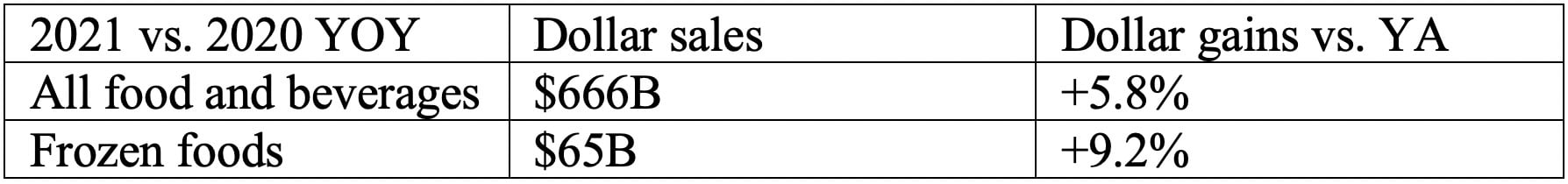

Not letting their investment go to waste, consumers continue to engage with the frozen food aisles at a high level. Over the latest 52 weeks ending in late May 2021, frozen food sales are still up 9.2% versus the same period a year ago, versus 5.8% for all foods and beverages. When shortening our performance look to just May of 2021, frozen foods were still 22.6% over and above their 2019 pre-pandemic baseline. This is still much higher than the +14.8% for total food and beverages. Across all 2021 months to date, frozen food gains have consistently been above 20% versus 2019, with matching unit and volume gains.

Source: IRI, MULO, 52 weeks ending 5/30/2021

Every brand, product or category has three ways to increase sales: having more people buy, having people buy more, and having people buy more often. Recent frozen food sales have been driven by all three factors. Photo [kupicoo]/[iStock / E+] via Getty Images

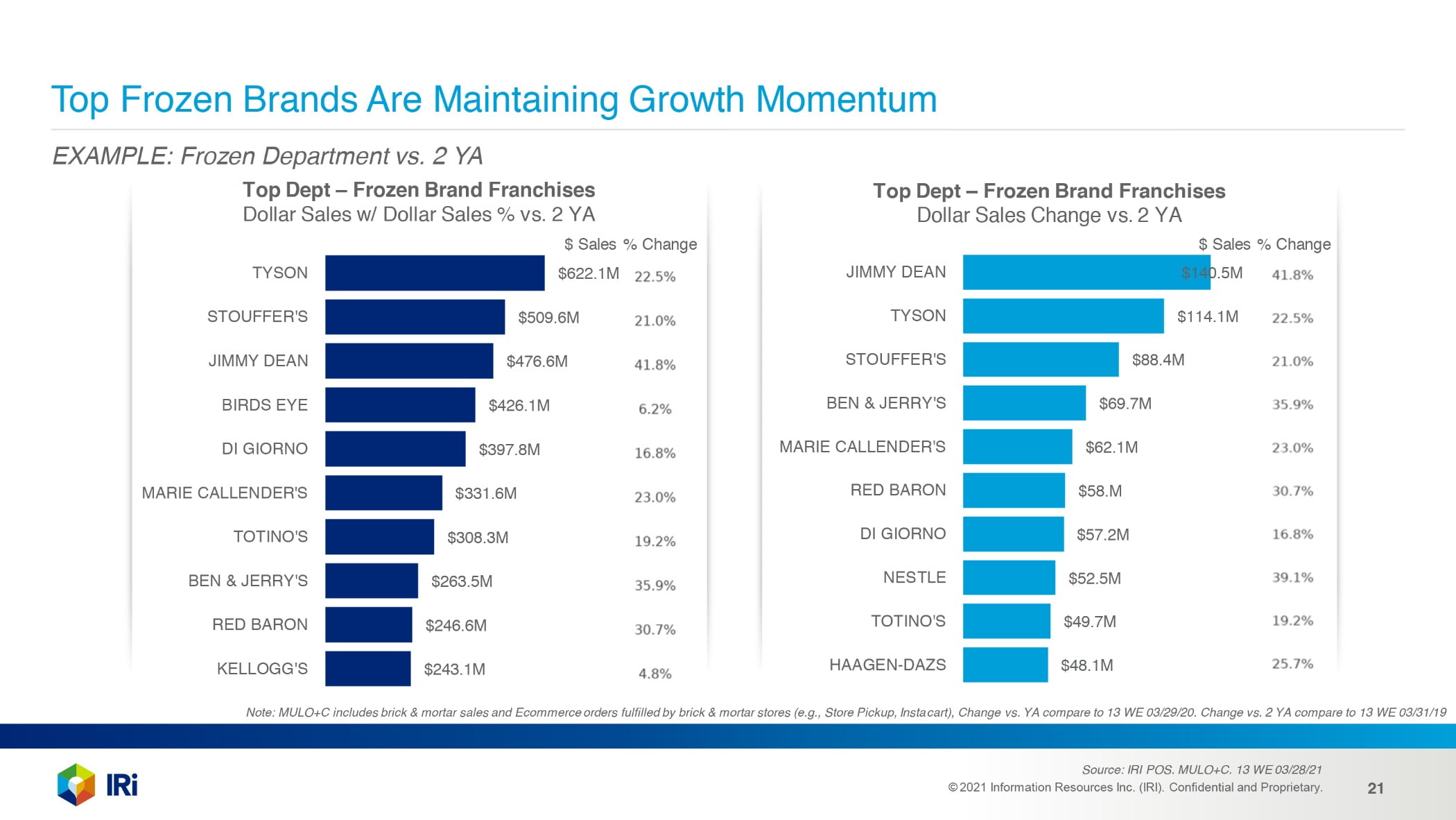

Several established frozen food brands have seen skyrocketing sales and growth since 2019. Chart courtesy of IRI Q1 2021 Emerging Growth Pockets.

It is important to note that many areas of the store see their sales growth percentages boosted by high levels of inflation whereas frozen food prices are holding the line or are even slightly less than they were in the late spring of 2020. That begs the question, what is driving this enormous strength of frozen foods? Here are a few of the growth drivers that prove the demand for frozen food will remain:

Cross-Assortment Engagement — Looking at sales patterns of the past few years, it isn’t just one or two areas in the frozen food aisle that are driving growth; it’s quite literally all categories. Certainly, there are powerhouses that have come on very strong in the past year, particularly frozen seafood and meat, but all areas gained and gained big.

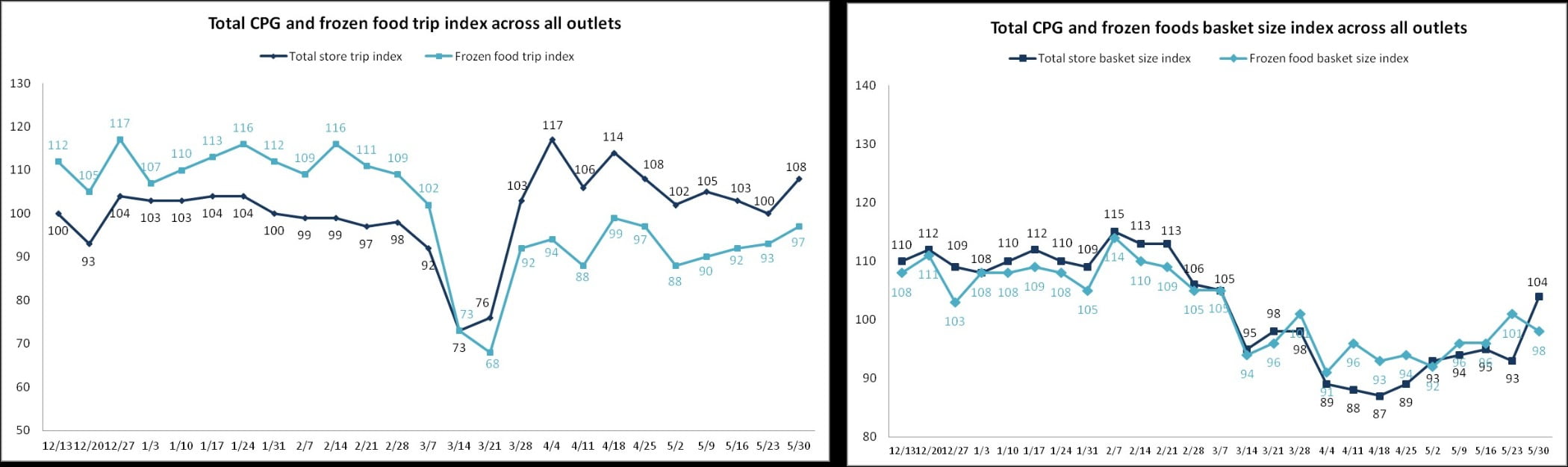

The Three Levers of Growth —Every brand, product or category has three ways to increase sales: having more people buy, having people buy more, and having people buy more often. Frozen food sales gains are the result of hitting this growth trifecta. Virtually every frozen food category saw an increase in household penetration, trips and the average basket size—an accomplishment not all departments can boast.

The 360 Win — Many categories play in breakfast versus dinner, or indulgence versus health. However, frozen foods cover it all: functional and indulgence plus all meal occasions from breakfast, lunch and dinner to beverages, snacks and desserts. Lunch became a huge growth opportunity during the pandemic as consumers emphasize time and convenience. With many more consumers continuing to work from home part or all of the time, frozen foods will continue to make inroads across meal occasions.

Online Food and Beverage Growth — While all retail channels gained over the past 15 months, it was food e-commerce that exploded, with a 2020 gain of 84%, according to IRI. Online now represents about 10% of all food sold in the U.S., and online growth has not yet plateaued with expected market penetration of about 12% by the end of 2021. Here too, frozen food rides a growth trend, with very high online conversion and penetration.

In spring of 2020, consumers took significantly fewer trips while spending 10%-15% more each visit. Frozen foods experienced an increase in trips hand-in-hand with an increase in spending, since many pandemic shoppers focused on buying foods with a longer shelf life, like frozen. Chart courtesy of IRI/210 Analytics May 2021 Frozen Update.

The list of growth drivers could continue but the bottom line is that all signs point to a bright future for frozen food demand. To learn more about how CPG manufacturers and retailers can leverage the current state of the frozen food department to continue driving growth and meet consumers’ evolving needs, join AFFI and IRI on Tuesday, August 3, 2021 for a strategy-focused webinar. For details and registration, click here.

Source: IRI, MULO, 52 weeks ending 5/30/2021