COLD CHAIN TRENDS

Cold Chain

Trends to

Watch

2023

Consumer demand for cold and frozen foods remains robust. For example, a survey released in November by the American Frozen Food Institute (AFFI) found more than a quarter of shoppers are buying more frozen fruits and vegetables than three years ago.

AFFI commissioned 210 Analytics to survey 1,500 households modeled to the U.S. Census to better understand shopper perceptions, shopping habits and applications of frozen fruits and vegetables. The report, “Frozen Fruits & Vegetables: Perceptions, Uses and Expectations among U.S. Consumers and SNAP-Eligible Households,” found 86% agreed that having frozen fruits and vegetables makes it easier to eat more produce and 83% reported that frozen fruits and vegetables help them to reduce food waste and save money due to the key attributes of frozen such as a longer shelf life and ability to only prepare what you need.

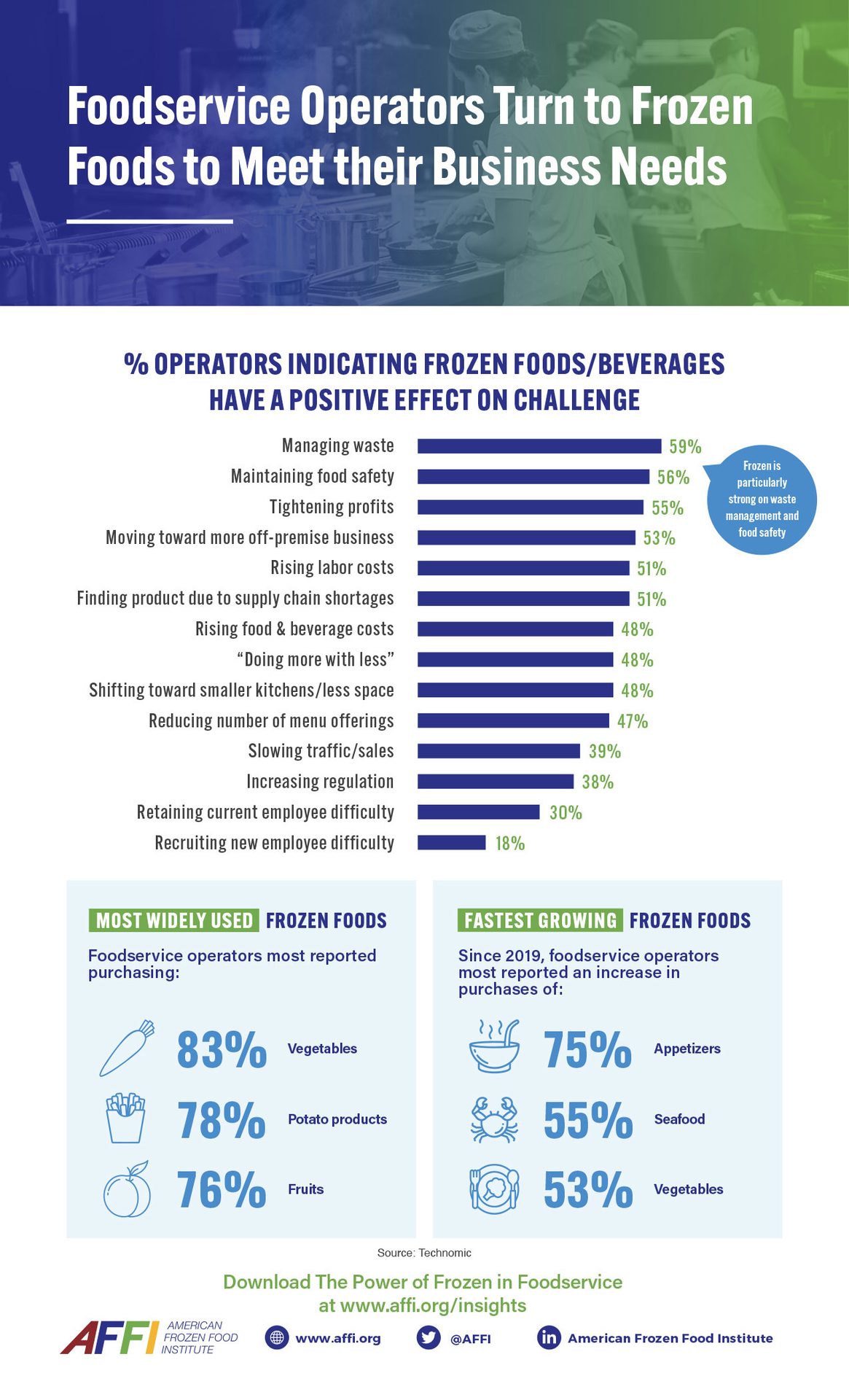

This data aligns with findings in AFFI’s “Power of Frozen 2021” market research which found that most consumers integrate both fresh and frozen produce in their meal planning. And recent AFFI research found that more than 90% of foodservice operators use frozen foods in their menus, with the healthcare, convenience store and fast casual categories reporting the greatest increase in use since 2019.

The second edition of the “Power of Frozen in Foodservice” issued qualitative and quantitative surveys among more than 350 operators from across 10 segments. Forty percent of foodservice operators surveyed reported purchasing more frozen foods than they did in 2019, with the fastest-growing products purchased by operators being appetizers (75% of operators indicated increased purchases since 2019), seafood (55%) and vegetables (53%).

Flavors, Experiences Key

With nine in 10 households’ principal shoppers reporting they buy groceries mostly in-store, branding, packaging and products offering meal solutions that meet shoppers’ evolving lifestyles can help retailers capture – and keep – share of stomach. As more consumers return to the office with a hybrid approach, shoppers will look to food manufacturers for quick meal options that offer more flavor, higher quality and fresher ingredients.

“Consumers today are all about new and interesting flavor experiences - especially younger Gen Z consumers. This certainly translates into flavors, think big, bold and unexpected - as well as types of cuisines like Peruvian and Chinese fusion for example,” said Nicole Desir, executive vice president of Brand & Communications for Fresh Realm, a provider of fresh meals at retailers nationwide. “Additionally, branding will play a key role. Standing out within the fresh prepared or frozen meals section can be difficult and brands that win will highlight the flavor value proposition in stand out ways.”

Desir said the pandemic has brought about a “new normal” when it comes to how people are eating throughout the course of the day.

“With hybrid work models, more people are working from – and eating – at home, presenting a strong daypart for the fresh and frozen meals categories and an opportunity to create single-serve options for those wanting something fresh, delicious and easy to prepare in between virtual meetings," she said.

As inflation pressures food costs, it will be important for manufacturers to redefine value.

“Consumers will look at value not just from a price perspective but also from a ‘value-add’ standpoint,” Desir said. “Meal options that are fresh, delicious and made from wholesome ingredients will drive their decisions, especially as takeout fatigue continues. We anticipate a continued increase in trips to the grocery store, not only to fill the pantry, but also for lunch and dinner solutions. Not all these consumers are seeking from-scratch meal solutions and they are pleased to find more foodservice solution options.”

Tastes in Plant-based

Many challenges occur when formulating with plant proteins — taste, texture and nutritional profiles, to name three. According to Kerry’s “Stepping Up Taste in Plant-Based” research, 85% of U.S. consumers agree that plant-based products should mimic both the taste and the texture of traditional products — not an easy benchmark to reach. “Natural” is another important attribute.

“Together, achieving these attributes is crucial to ensuring repeat purchases by flexitarians who eat both meat and plant-based products - they will continue to buy the latter only if it tastes at least as good as meat. To gain a significant following and foothold and repeat purchases in the marketplace, therefore, this is the prevailing standard to which product developers must devote their efforts,” said Kelly Heathington, business development director of Meat Systems for Kerry Taste & Nutrition.

Coatings for plant-based products are highly nuanced versus a typical coating product. Some of the biggest issues stem from texture and moisture differences between plant-based proteins and real meat, like adhesion.

“This is due to the fact that coatings react differently in plant-based applications, i.e., the former often struggle to deliver the texture and the ‘meat-like’ bite consumers are seeking. Also related to adhesion is the issue of moisturemigration — optimization on this front is vital given that moisture behaves and looks differently in an alternative protein versus an animal one,” Heathington said. “Building a tasty plant-based product that will gain acceptance requires both an excellent coating system and a good array of protein ingredients in a producer’s design palette — and this is not even to mention taste/texture enhancements and suitable binding systems.”

From managing off-notes to injecting an authentic taste experience, many plant-based producers continue to struggle to reach consumer expectations. The good news is that the future of plant-based meat is ripe for innovation and flavor exploration. For example, Kerry’s sensory research shows there is currently no “industry standard” flavor and texture profile for nuggets, “leaving product developers free to be both flexible and creative,” Heathington said.

Image courtesy of Thermo King.

The “Power of Frozen in Foodservice” issued surveys to over 350 operators across 10 segments. Image courtesy of AFFI.

Keeping the Cold Chain Moving

As cold buildings continue to climb higher, one of the emerging trends in material handling is the use of pallet shuttles.

“Pallet shuttles provide very dense storage and are highly modular and scalable. The dense storage minimizes your building size which in-turn helps minimize the carbon footprint. Correctly implemented, pallet shuttles can also greatly reduce single points of failure, thereby maximizing system availability ensuring orders get out on time,” said Tom Swovick, global market development director of Food, Beverage and CPG at Dematic, a supplier of materials handling systems, software and services. “An industry statistic for North America shows that between 2014 and 2021, Automated Storage and Retrieval Systems (ASRS) under 75 feet had a single digit CAGR, whereas systems over 75 feet had a CAGR in excess of 30%. This general statistic will be even more dramatic for cold storage.”

Modified atmosphere (nitrogen rich) fire suppression is on the verge of important insurance underwriting milestones. This technology will eliminate the need for in rack sprinklers, which will increase cube efficiency and simplify project installation and ongoing sprinkler system maintenance.

Cold chain operators are repeatedly finding robotics and IoT are vital to meeting the increasingly complex and challenging order fulfillment requirements of their customers when considering the dimensions of ever-increasing SKU and order complexity, order accuracy requirements and on-time shipment needs.

“IoT is also playing an ever-increasing role in keep food safe for the consumer, assuring the proper temperatures are maintained through the chain of custody along the supply chain,” Swovick said.

High demand for cold storage space is expected to continue throughout the year and the booming cold storage and broader industrial markets will drive competition for space.

As a result, experts say retrofitting existing space or speculative projects will likely increase. Cold storage distribution space in smaller metro areas is also becoming increasingly attractive, with smaller-scale facilities suited for distribution within these markets.

Swovick said one misconception is that it is impractical to automate an existing 30-foot building.

“The pallet shuttle technology described earlier can effectively automate an existing building of that height; buildings of that height that have a flat floor in good condition could also be automated using automated guided vehicles,” he said.

Additionally, building designs that minimize footprint, automated outbound staging and a continued focus on reducing energy loss and sustainability initiatives will remain hot in 2023.